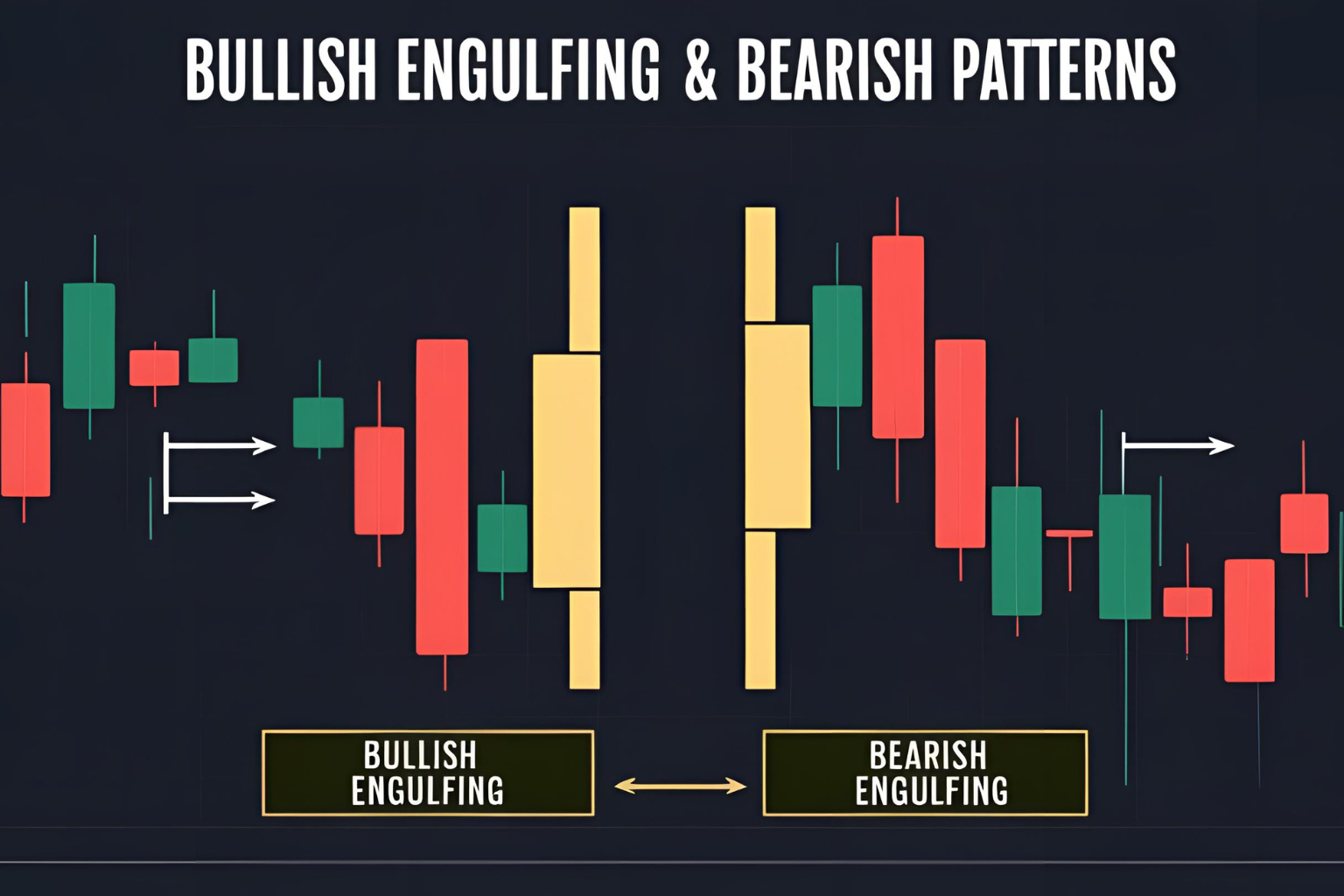

Bullish Engulfing & Bearish Engulfing for Intraday Trading

Among all candlestick patterns used in intraday trading, bullish and bearish engulfing patterns are some of the most powerful. They offer strong signals of potential reversals and can help you make faster and more confident trading decisions. This guide explains how these patterns work, how to identify them, and how to trade them in real-time.

What Is a Bullish Engulfing Pattern?

A bullish engulfing forms when a large green (bullish) candle completely covers the body of the previous red (bearish) candle.

Key Characteristics:

- Appears after a downtrend or pullback.

- Second candle closes above the high of the previous candle.

- Signals bullish reversal.

What Is a Bearish Engulfing Pattern?

A bearish engulfing forms when a large red (bearish) candle completely covers the body of the previous green (bullish) candle.

Key Characteristics:

- Appears after an uptrend or rally.

- Second candle closes below the low of the previous candle.

- Signals bearish reversal.

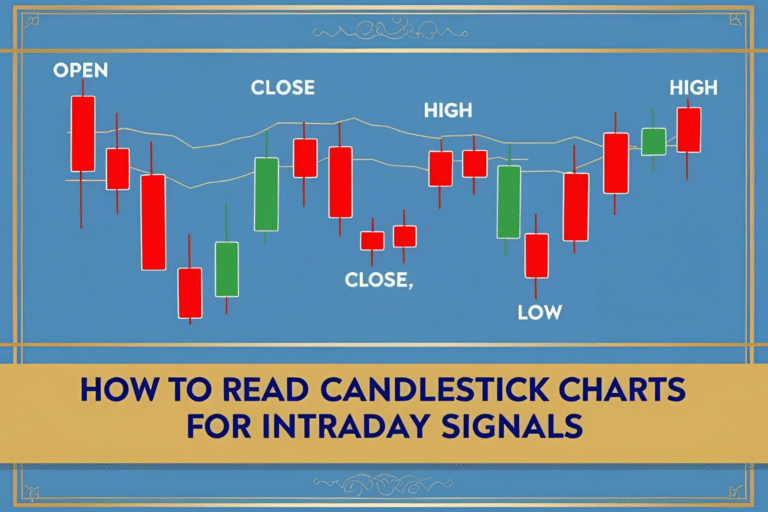

How to Identify Engulfing Patterns in Intraday Charts

- Use a 5-minute or 15-minute candlestick chart.

- Spot trend movement before the pattern forms.

- Look for clear engulfing candles with volume increase.

- Confirm near support or resistance zones for better accuracy.

How to Trade the Bullish Engulfing Pattern

- Entry: Above the high of the bullish engulfing candle.

- Stop-Loss: Below the low of the same candle.

- Target: Previous swing highs or 1:2 risk-reward level.

How to Trade the Bearish Engulfing Pattern

- Entry: Below the low of the bearish engulfing candle.

- Stop-Loss: Above the high of that candle.

- Target: Recent swing lows or next support level.

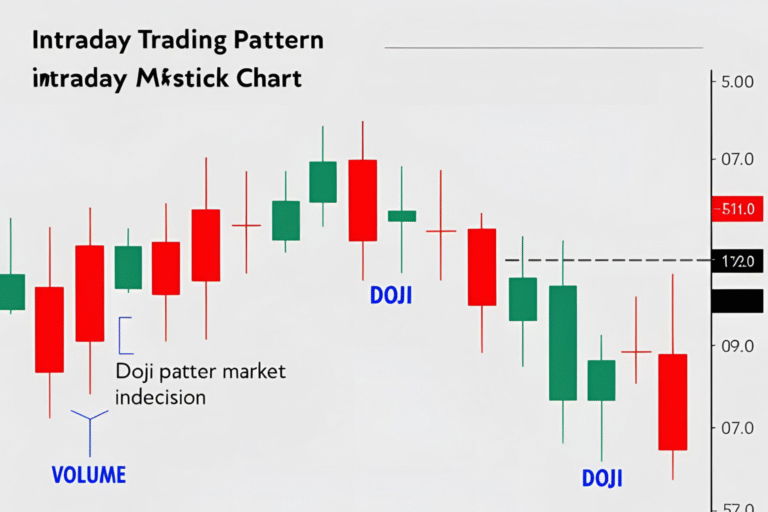

Pro Tips for Intraday Traders

- Use volume confirmation. Stronger engulfing patterns show increasing volume.

- Avoid trading engulfing patterns during news events or low liquidity.

- Combine with indicators like VWAP or RSI for added confirmation.

- Look for clean price action with minimal noise around the pattern.

Common Mistakes to Avoid

- Trading without confirmation (e.g., entering too early).

- Ignoring market structure or trend direction.

- Using large position sizes without stops.

Final Thoughts

Bullish and bearish engulfing patterns are powerful tools in the intraday trader’s arsenal. When used correctly with proper confirmation and risk management, they can signal high-probability reversals and trend shifts. Practice spotting them in different timeframes to build your confidence.

FAQs

Are engulfing patterns reliable for intraday trades?

Yes, especially when combined with volume and clear market structure.

Which timeframe is best for engulfing patterns?

The 5-minute and 15-minute charts are most suitable for intraday use.

Can engulfing patterns fail?

Yes. Always use a stop-loss and confirm the setup before entering a trade.

Should I use indicators with engulfing patterns?

Yes, combining with RSI, MACD, or VWAP enhances accuracy.

Can engulfing patterns be used in all markets?

Yes. They work across stocks, forex, crypto, and index futures.