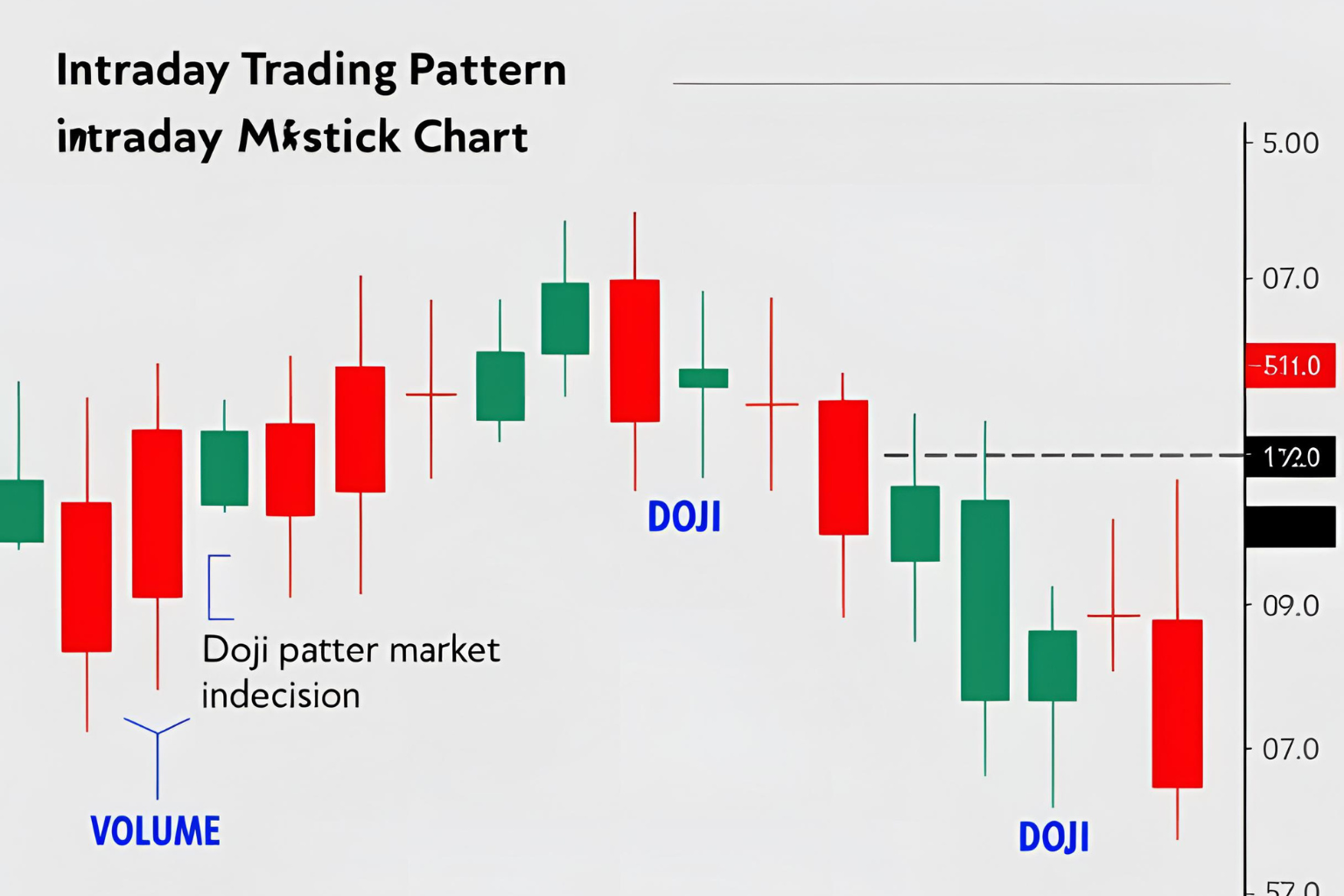

Using Doji Candlestick in Intraday Strategy

The Doji candlestick is one of the most important signals in technical analysis. In intraday trading, it often marks a pause in momentum, a potential reversal, or an early sign of consolidation. In this post, we’ll break down how to spot Doji patterns and use them as part of a smart intraday trading strategy.

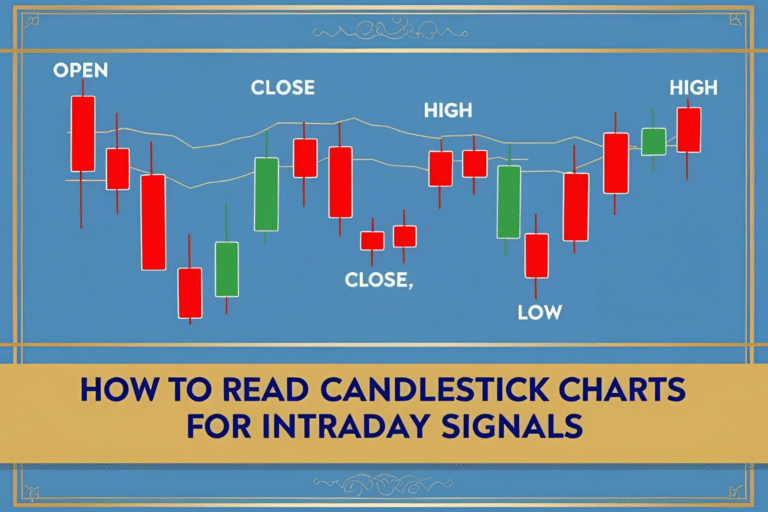

What Is a Doji Candlestick?

A Doji forms when the open and close prices are nearly equal, creating a candle with a very small body and long upper/lower wicks.

It signals:

- Indecision in the market

- A balance between buyers and sellers

- A potential turning point when it appears at key levels

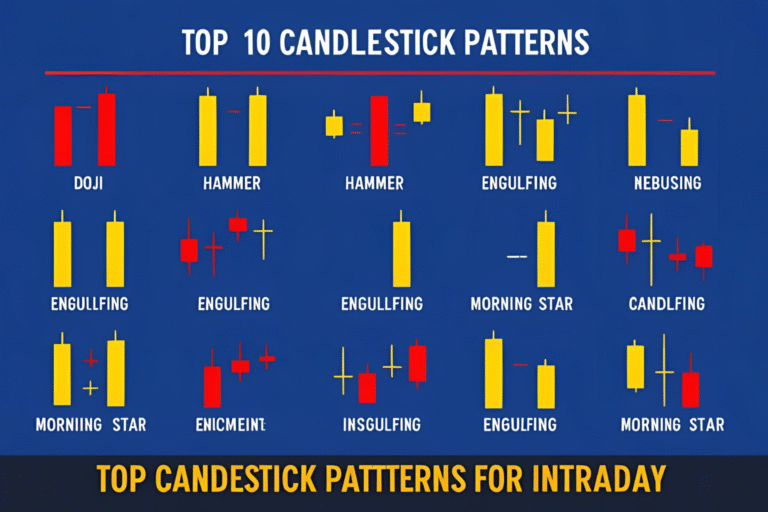

Types of Doji Candles

- Standard Doji: Small body, equal upper and lower wicks.

- Long-Legged Doji: Very long wicks on both sides.

- Gravestone Doji: Open and close at the low of the candle.

- Dragonfly Doji: Open and close at the high of the candle.

How to Trade Doji Candles in Intraday

1. At Support or Resistance Zones

- A Doji at key levels may signal a reversal.

- Confirm with volume or the next candle’s direction.

2. In a Strong Trend

- A Doji in an uptrend may indicate slowing momentum.

- Prepare for a possible pullback or reversal setup.

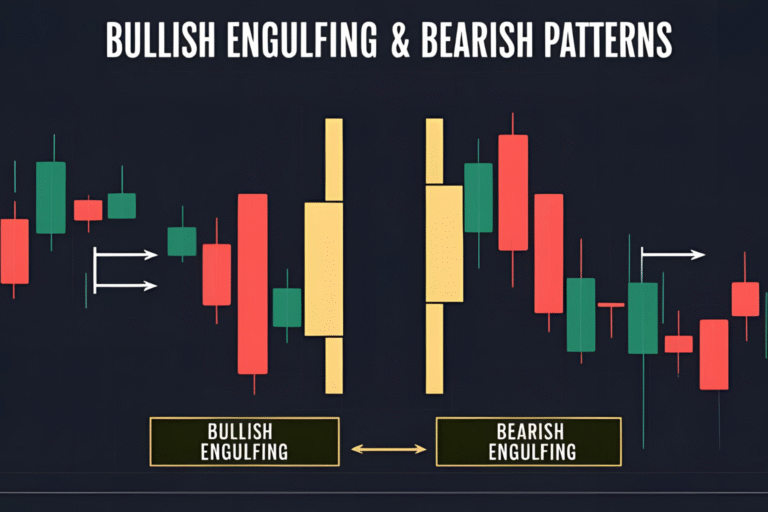

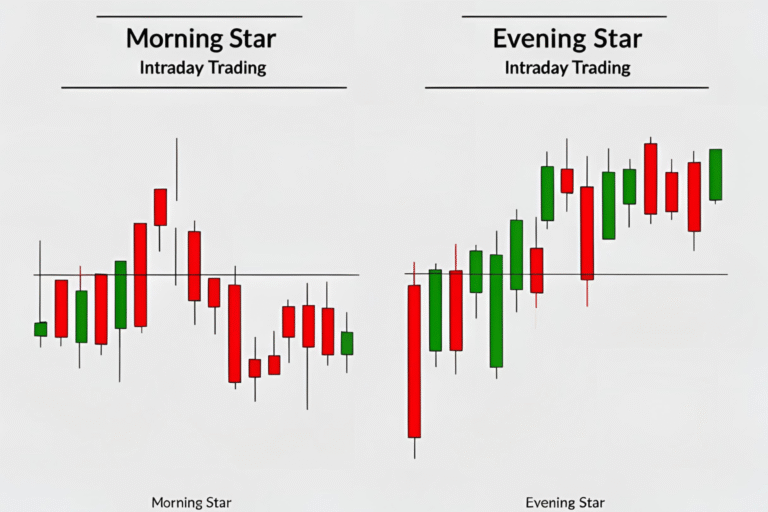

3. With Other Patterns

- Combine with engulfing or star patterns for high-confidence entries.

Entry and Exit Strategy

- Entry: Wait for the next candle after the Doji to confirm direction.

- Stop-Loss: Place just beyond the high/low of the Doji.

- Exit: Use 1:2 risk-reward or nearest key level.

When to Avoid Trading a Doji

- In sideways markets where Dojis occur frequently.

- During news events with high volatility.

- When there’s no trend or context to support a reversal.

Chart Example

Scenario: A Dragonfly Doji appears on the 5-minute chart near intraday support with increasing volume.

Action: Enter long on the next bullish candle. Set stop-loss below the Doji’s low.

Final Thoughts

The Doji candlestick is a subtle yet powerful signal for intraday traders. Used in the right context—near support/resistance or as part of a pattern—it can signal precise entry and exit points. Remember, confirmation is key. Never trade a Doji in isolation.

FAQs

What does a Doji mean in intraday trading?

It shows indecision and is often a sign that the current trend may pause or reverse.

Which timeframe is best for spotting Dojis?

5-minute and 15-minute charts are ideal for intraday use.

Are all Doji patterns reliable?

No. Only trade Dojis with context—support/resistance, trend, or volume confirmation.

Should I wait for the next candle after a Doji?

Yes, the next candle confirms whether buyers or sellers take control.

Do Doji candles appear often in intraday charts?

Yes, but not all are trade-worthy. Focus on those with clean structure and setup alignment.