Risk Management for Pattern-Based Intraday Trading

Even the best chart pattern won’t save your trade if you ignore risk management. In intraday trading, controlling your downside is more important than chasing profits. This guide covers essential risk management strategies every trader should apply when trading chart patterns.

Why Risk Management Matters

Intraday markets move fast. Without a risk plan:

- One bad trade can wipe out multiple winners.

- Emotional decisions lead to overtrading.

- Traders get trapped in losing positions.

A sound risk management system gives you consistency, control, and peace of mind.

Key Risk Management Concepts

1. Position Sizing

- Risk only 1–2% of your trading capital on a single trade.

- Use this formula:

Position Size = Capital × Risk % / Stop-Loss Points

2. Use a Stop-Loss

- Never enter a trade without a predefined stop-loss.

- Place it based on the pattern:

- Just below the low of a bullish pattern

- Just above the high of a bearish pattern

3. Reward-to-Risk Ratio

- Always aim for a minimum 1:2 ratio.

- Avoid setups that don’t offer good R:R.

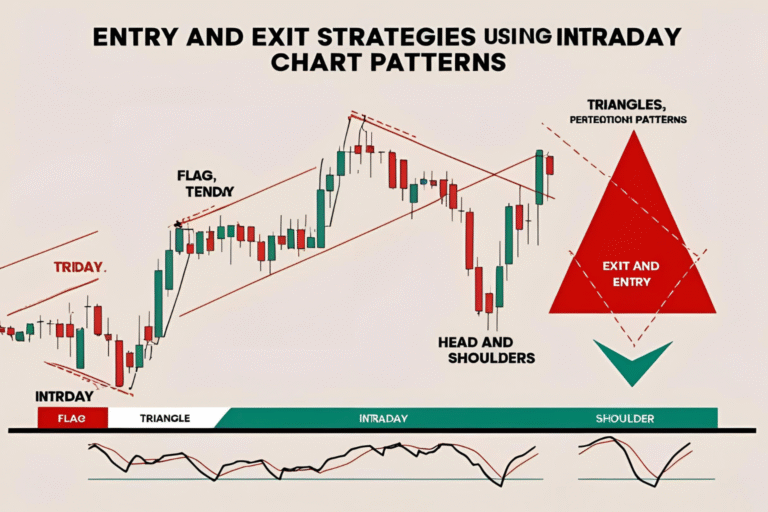

Pattern-Specific Risk Planning

| Pattern Type | Suggested Stop-Loss | Suggested Target |

|---|---|---|

| Bull Flag | Below flag support | Previous swing high |

| Head & Shoulders | Above right shoulder (short) | Neckline measured move |

| Triangle Breakout | Inside triangle opposite edge | 1.5x to 2x triangle height |

| Double Bottom | Below the pattern low | Neckline breakout projection |

Avoid These Risk Mistakes

- Trading without a stop-loss

- Increasing lot size after losses (revenge trading)

- Risking more on patterns you “like”

- Ignoring volatility and time of day

Tools That Help

- Risk Calculator Tools (built into most trading platforms)

- ATR Indicator: Helps you set stop-loss based on volatility

- Trade Journal: Record and analyze your risk decisions

Final Thoughts

Risk management is the foundation of long-term intraday success. Patterns help you find trades; risk rules help you survive the game. Stick to your stop, stay within your limits, and never risk money you can’t afford to lose.

FAQs

How much should I risk per intraday trade?

Most professionals recommend risking only 1–2% of your total capital per trade.

What’s the best stop-loss strategy for intraday trading?

Pattern-based stop-losses—just outside key support/resistance zones—are most reliable.

Can I trade without a stop-loss if I’m confident in the pattern?

No. Even the best setups can fail. A stop-loss is non-negotiable.

Is a higher reward-to-risk ratio always better?

Not always. You want consistent setups with a realistic balance of win rate and R:R.

Should I adjust position size based on the pattern type?

Yes. If a pattern has a wide stop-loss, reduce your lot size to control risk.