How to Scan for Intraday Patterns in Real Time

Timing is everything in intraday trading. Spotting chart patterns seconds after they form gives traders a strong edge. In this guide, you’ll learn how to scan for intraday patterns in real time—using tools, techniques, and scanners that help you find opportunities before they move.

Why Real-Time Pattern Scanning Matters

- Speed: Intraday moves are short-lived. Delay = missed opportunity.

- Efficiency: You can’t manually monitor dozens of charts all day.

- Consistency: Automated scans reduce emotion and guesswork.

What to Scan for in Intraday Trading

Common real-time pattern targets include:

- Breakout patterns (triangle, flag, rectangle)

- Reversal patterns (double top/bottom, head & shoulders)

- Candlestick patterns (engulfing, doji, pin bar)

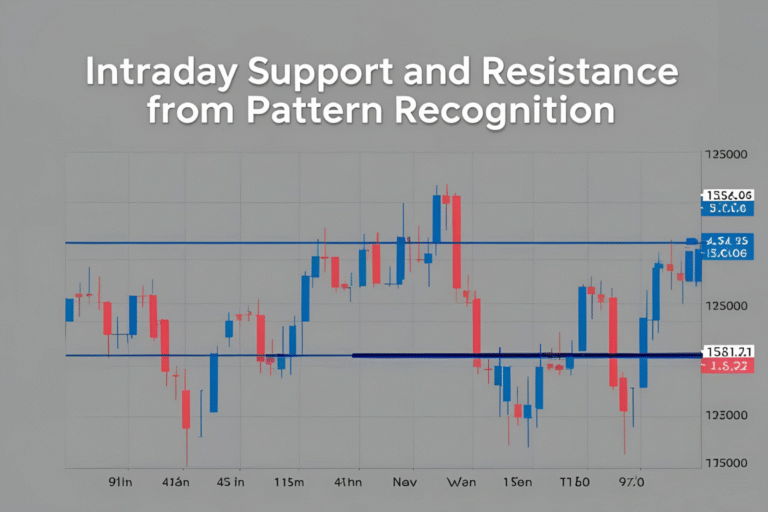

- Volume breakouts near support/resistance

Best Tools to Scan for Patterns in Real Time

1. TradingView

- Use built-in Pine Script alerts for pattern detection

- Community scripts: e.g., “Chart Pattern Recognition,” “Auto Trendlines”

2. Amibroker (with AFL)

- Custom AFL scripts detect breakout setups and candlestick patterns

- Add auto-alerts or sound notifications

3. Chartink (India)

- Web-based screener that scans for custom intraday patterns on NSE/BSE

- Set up real-time alerts with indicator combinations

4. Trade Ideas (Global)

- AI-powered pattern scanning

- Useful for U.S. markets—flags, breakouts, reversals, and volume surges

5. MetaStock / NinjaTrader

- Suitable for advanced real-time scanning setups

Setting Up an Intraday Pattern Scan (Example: Flag Breakout)

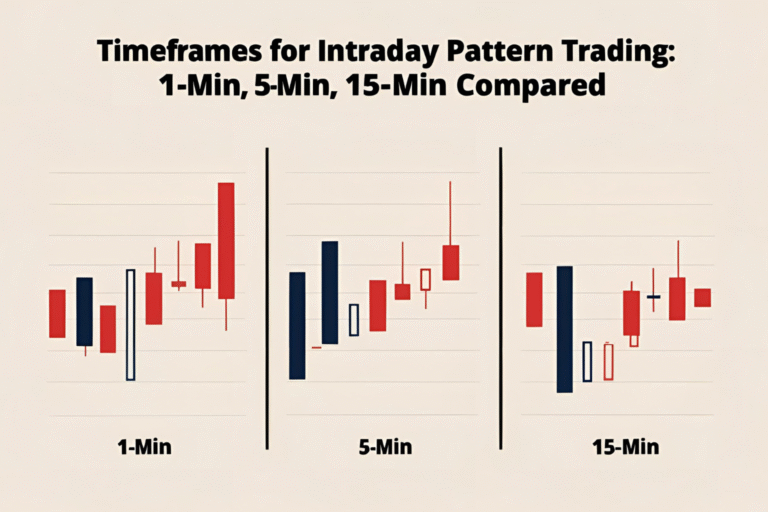

- Timeframe: 5-minute

- Conditions:

- Price above 20 EMA

- Volume increase on breakout candle

- Pattern recognition: Higher lows, flat top

- Action:

- Trigger alert once breakout candle closes above resistance

- Entry/exit strategy follows after alert confirmation

Tips for Better Real-Time Scanning

- Avoid cluttered scans—focus on 1–2 pattern types at a time

- Use volume filters to catch high-quality setups

- Set alerts for both breakouts and breakdowns

- Adjust scan logic based on time of day (morning vs. afternoon trades)

Final Thoughts

Real-time pattern scanning is your shortcut to faster decisions and more trade opportunities. With the right tool and a refined strategy, you can automate the heavy lifting and focus on execution. Start with one or two patterns, optimize your scanner, and improve with every session.

FAQs

What’s the best scanner for intraday patterns?

TradingView and Chartink are widely used. Amibroker is great for advanced users with custom AFL strategies.

Can I scan for patterns on mobile?

Yes. Apps like TradingView and Chartink support mobile alerts for intraday setups.

Do I need to code for pattern scanning?

Not always. Many platforms offer pre-built scanners or community scripts.

How often should I run the scanner?

Use real-time or refresh every 1–5 minutes for best results during market hours.

Can scanners guarantee profitable trades?

No, scanners only identify setups. You still need to confirm and manage risk manually.