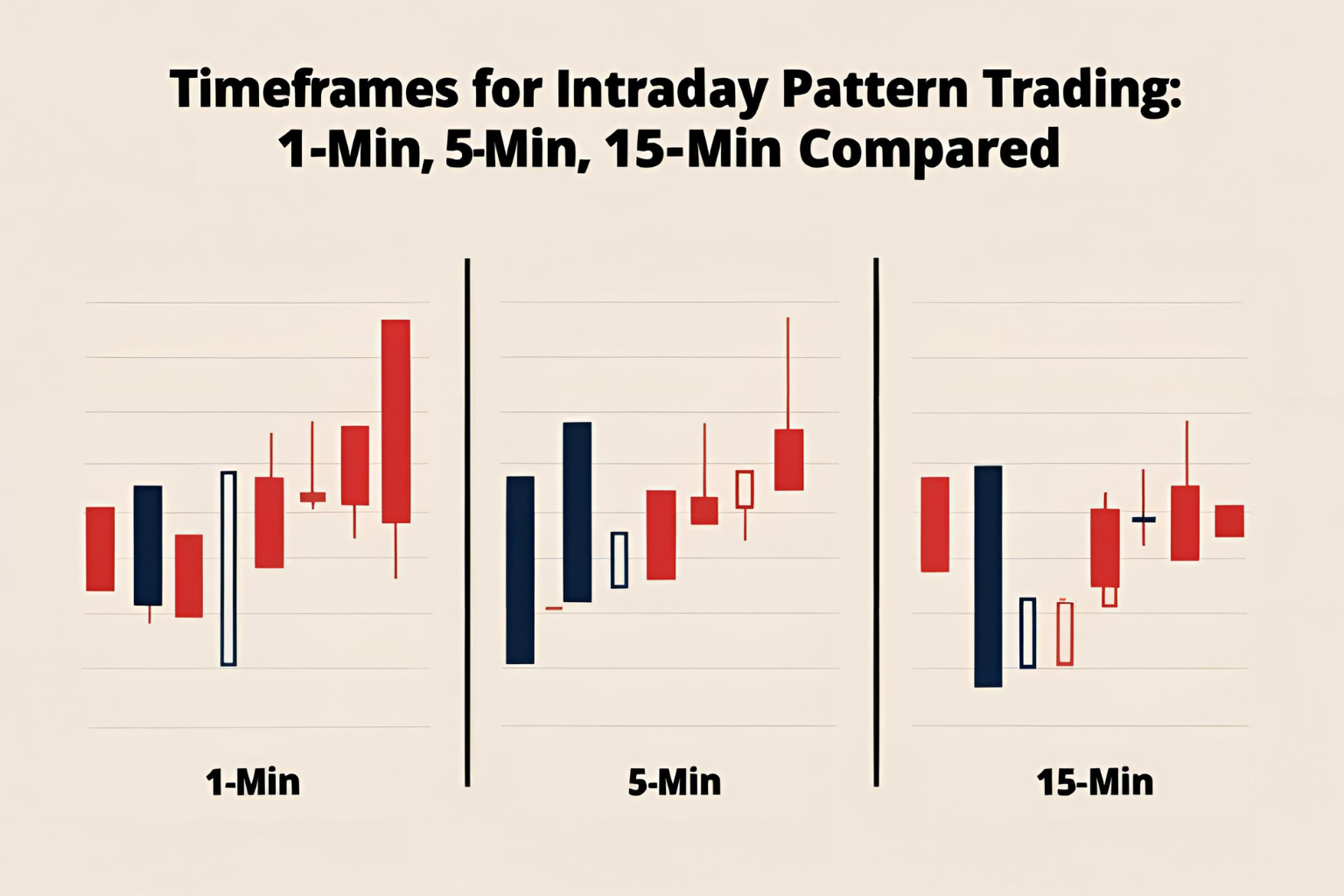

Timeframes for Intraday Pattern Trading: 1-Min, 5-Min, 15-Min Compared

Choosing the right timeframe is a crucial part of intraday pattern trading. The chart you use affects your entry speed, pattern clarity, and risk management. In this guide, we compare the 1-minute, 5-minute, and 15-minute timeframes to help you select the one that suits your style and strategy best.

Why Timeframe Selection Matters

- Too short: More signals, more noise, higher risk of false entries.

- Too long: Fewer signals, delayed entries, wider stop-loss.

- Just right: Balanced view of trend, pattern clarity, and risk control.

1-Minute Chart (Ultra-Short-Term)

Best for:

- Scalpers

- High-frequency setups

- Quick entries/exits within minutes

Advantages:

- Fast signals

- More setups per session

Drawbacks:

- High noise

- More fake patterns

- Requires intense focus and quick reaction

Use With:

- Flag patterns

- Micro breakouts

- Momentum candles near VWAP

5-Minute Chart (Most Popular)

Best for:

- Active intraday traders

- Balanced speed and accuracy

Advantages:

- Clear pattern formation

- Less noise than 1-min

- More trades per session than 15-min

Drawbacks:

- Still fast-paced

- Requires quick decision-making

Use With:

- Triangle patterns

- Bullish/bearish engulfing

- Double bottom/top near support/resistance

15-Minute Chart (Short-Term Swing-Intraday)

Best for:

- Precision entries

- Strong confirmation

- Traders who hold for hours, not minutes

Advantages:

- More reliable patterns

- Strong confirmation signals

- Better suited for large-cap stocks or index trades

Drawbacks:

- Fewer setups per day

- Larger stop-loss range

Use With:

- Head & shoulders

- Cup and handle

- Triangle breakouts with volume confirmation

Which Timeframe Should You Use?

| Trader Type | Recommended Timeframe | Reason |

|---|---|---|

| Scalper | 1-Min | Fast trades, quick profits |

| Pattern Trader | 5-Min | Best balance of signals & accuracy |

| Precision Trader | 15-Min | Fewer, stronger setups |

Pro Tips

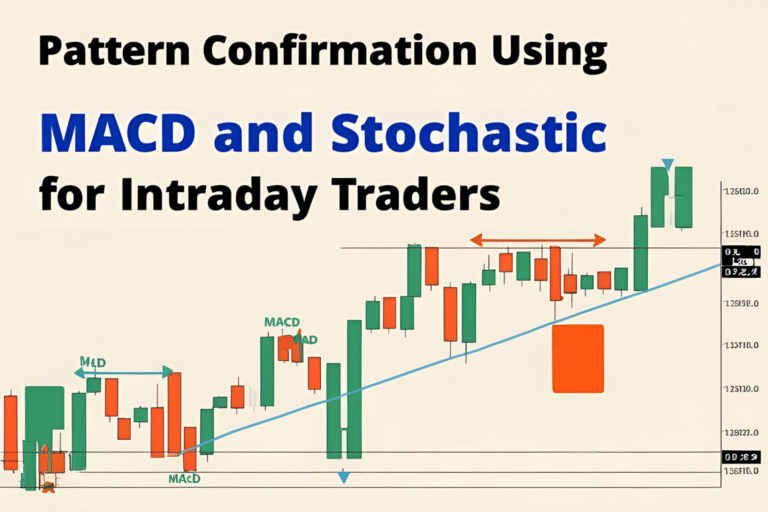

- Use multi-timeframe confirmation (e.g., pattern on 5-min, trend on 15-min).

- Match your risk tolerance and screen time to the chart speed.

- Practice your strategy in replay mode before going live.

Final Thoughts

No timeframe is “best” for everyone. It depends on your style, speed, and strategy. The 5-minute chart is ideal for most intraday pattern traders, offering a good mix of clarity and opportunity. Experiment with all three to find what works best for you.

FAQs

Which timeframe is best for intraday pattern trading?

The 5-minute chart is the most commonly used for a balance of reliability and signal frequency.

Is 1-minute trading too risky?

It can be. It requires strict discipline, fast reaction, and high-quality setups to succeed.

Can I mix timeframes?

Yes. Many traders use the 15-minute chart for trend direction and the 5-minute for entry.

Are patterns more reliable on higher timeframes?

Yes, but they offer fewer signals. It’s a trade-off between quality and quantity.

Should beginners start with 1-minute charts?

No. Start with 5-min or 15-min to avoid overtrading and emotional decision-making