Best Tools and Scanners to Detect Intraday Patterns

In fast-moving intraday markets, spotting patterns manually on dozens of charts is nearly impossible. That’s where real-time tools and scanners come in. They automate detection, alert you instantly, and help you focus only on high-probability trades. This post covers the best tools and scanners to detect intraday chart patterns efficiently.

Why You Need Pattern Detection Tools

- Speed: Alerts you before a breakout completes.

- Efficiency: Scans multiple stocks in seconds.

- Accuracy: Uses consistent criteria, reducing emotional bias.

Top Tools & Scanners for Intraday Pattern Detection

1. TradingView

- Best for: Global stocks, crypto, indices

- Key features:

- Custom Pine Scripts

- Built-in chart pattern recognition

- Realtime alerts on breakouts, candlestick patterns, and trendlines

2. Chartink (India-focused)

- Best for: NSE/BSE intraday stocks

- Key features:

- Custom filter builder

- Live breakout and candlestick scanners

- Free and premium alerts

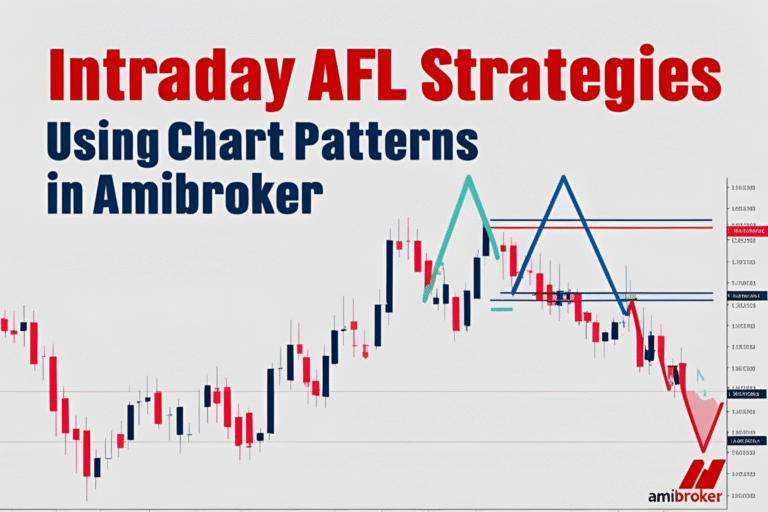

3. Amibroker with AFL

- Best for: Advanced pattern scripting

- Key features:

- Write custom AFL code for patterns

- Backtesting capability

- Ideal for automated signal generation

4. Trade Ideas

- Best for: U.S. equities, active traders

- Key features:

- AI-assisted trade detection

- Real-time breakout, flag, and reversal pattern scans

- Configurable alerts and simulated trading

5. Scanz

- Best for: Nasdaq/NYSE stocks

- Key features:

- Real-time chart pattern scanner

- Price action filters

- Built-in news and volume surge detection

What to Look for in a Scanner

- Custom pattern support (e.g., flags, triangles, candlesticks)

- Realtime alerts (push/email/desktop popups)

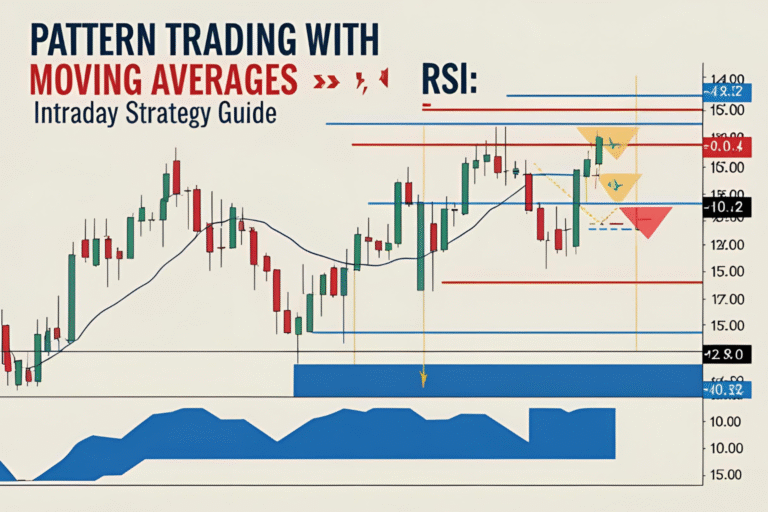

- Multiple timeframe support

- Volume and trend filters

- Ease of use for live market conditions

Example Use Case: Detecting Breakout Patterns

Platform: TradingView

Pattern: Ascending Triangle

Logic:

- Flat resistance

- Higher lows

- Volume increase near breakout

Alert setup:

Trigger on close above resistance + volume surge

Final Thoughts

Tools and scanners give intraday traders a clear advantage in spotting setups quickly and consistently. Whether you’re trading U.S. stocks, Indian markets, or forex, the right scanner can save hours and increase accuracy. Test different platforms and scripts until you find a workflow that fits your strategy.

FAQs

What’s the best free tool to detect intraday patterns?

TradingView (free version) and Chartink offer powerful scanners at no cost.

Can I use these tools on mobile?

Yes. TradingView, Chartink, and others have mobile apps with real-time alerts.

Do I need coding knowledge to use scanners?

Not always. Platforms like Chartink and Trade Ideas offer point-and-click builders. Amibroker requires AFL scripting.

Are paid scanners worth it?

Yes—if you trade actively and need speed and customization, paid tools offer more features and flexibility.

Can I detect candlestick patterns in real time?

Yes. Most platforms can scan for patterns like engulfing, doji, and hammer in real time with volume filters.