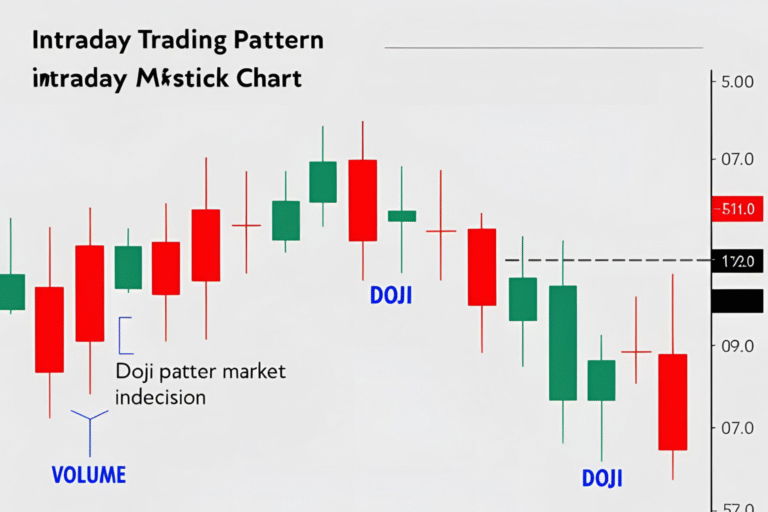

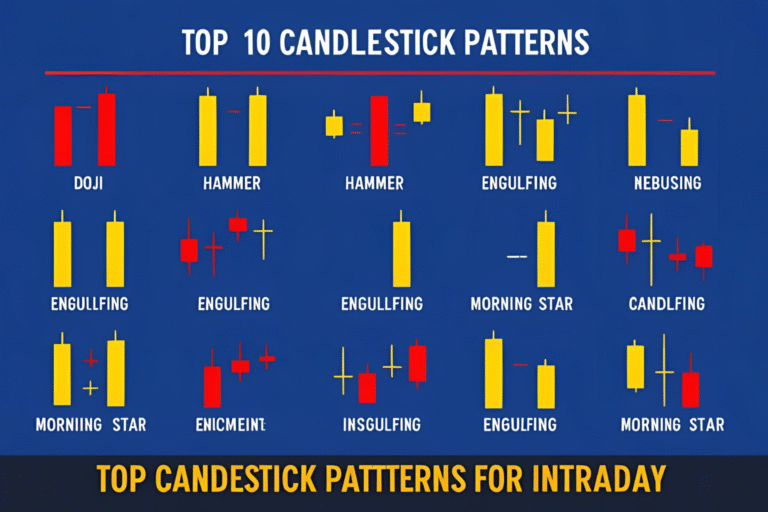

Using Doji Candlestick in Intraday Strategy

The Doji candlestick is one of the most important signals in technical analysis. In intraday trading, it often marks a pause in momentum, a potential reversal, or an early sign of consolidation. In this post, we’ll break down how to spot Doji patterns and use them as part of a smart intraday trading strategy. What…