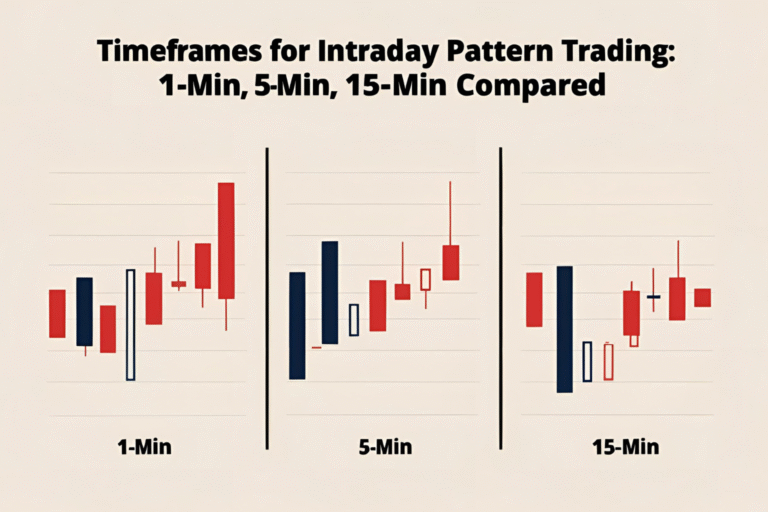

Timeframes for Intraday Pattern Trading: 1-Min, 5-Min, 15-Min Compared

Choosing the right timeframe is a crucial part of intraday pattern trading. The chart you use affects your entry speed, pattern clarity, and risk management. In this guide, we compare the 1-minute, 5-minute, and 15-minute timeframes to help you select the one that suits your style and strategy best. Why Timeframe Selection Matters 1-Minute Chart…