Chart Pattern Failures: What to Do When a Setup Breaks

Even the best chart patterns fail. No matter how perfect the setup looks, the market doesn’t always behave as expected. For intraday traders, learning how to spot and react to chart pattern failures is just as important as recognizing successful setups. This article will help you understand why patterns fail and how to manage them with discipline.

Why Chart Patterns Fail

Understanding the cause of failure is the first step in adapting to market realities.

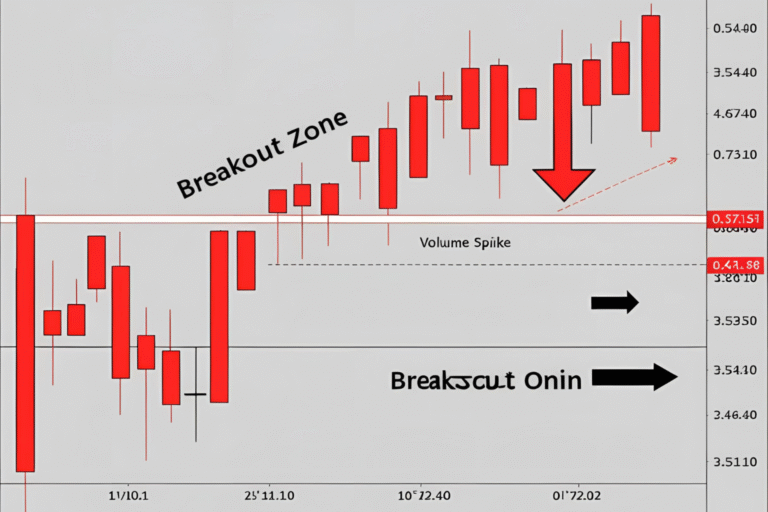

- False Breakouts: Price moves beyond support/resistance but quickly reverses.

- Low Volume: Breakouts without volume are often unreliable.

- News Volatility: Sudden headlines or data releases can reverse patterns instantly.

- Premature Entries: Entering before confirmation leads to early stop-outs.

- Overcrowded Trades: If too many traders anticipate a pattern, smart money may push it the other way.

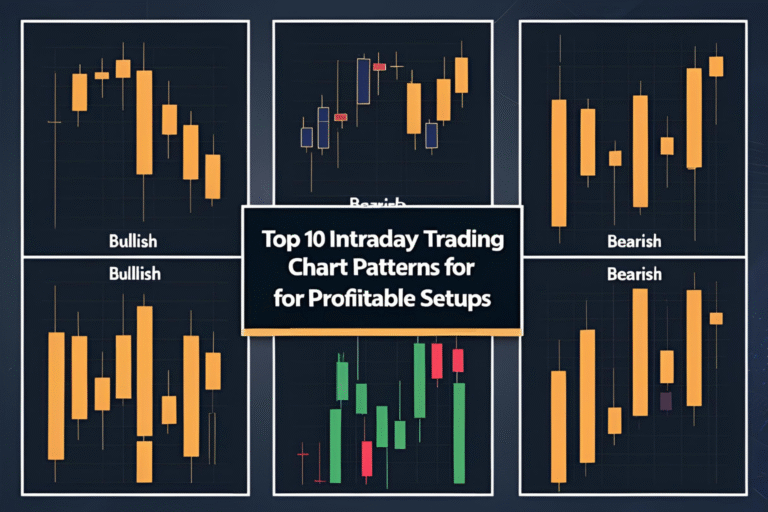

Signs a Pattern Is Failing

- No Volume on Breakout

- Price Re-enters the Pattern Zone

- Reversal Candlestick Appears

- Stops Being Hit Too Often

- Market Sentiment Conflicts with Pattern Direction

How to React When a Pattern Fails

1. Exit Immediately

Once the setup is invalidated, exit without hesitation. Holding and hoping can worsen losses.

2. Use a Stop-Loss

Always place a stop at logical points (just outside the pattern) to protect your capital.

3. Reverse the Trade (Advanced)

Some traders reverse their position after a failed breakout—known as a “trap trade”—but this requires confidence and skill.

4. Analyze What Went Wrong

Was it a news event? Was volume missing? Use the failure to learn and improve future setups.

5. Avoid Overtrading

Don’t jump into a new trade immediately after a loss. Wait for the next clean setup.

Pattern Failure Example

Pattern: Ascending Triangle

Expected Move: Breakout above resistance

Failure Sign: Breakout occurs on low volume, then price falls below the rising trendline

Action: Stop-loss hit. Exit immediately. Wait for the market to reset.

How to Minimize Pattern Failures

- Wait for Confirmation: Avoid entering on anticipation.

- Watch Volume: Strong volume supports valid moves.

- Use Secondary Indicators: RSI, MACD, or VWAP can confirm direction.

- Know Market Context: Avoid pattern trading during major events or earnings releases.

Final Thoughts

Chart pattern failures are part of intraday trading. What separates successful traders from the rest is how they react. Use every failure as a chance to learn, refine your system, and protect your trading capital. Survival in trading comes from cutting losses quickly and letting winners run.

FAQs

Why do chart patterns fail in intraday trading?

Due to false breakouts, low volume, news volatility, or market manipulation.

How do I identify a failing pattern?

Look for a lack of volume, reversal candles, or the price re-entering the pattern zone.

Is it okay to reverse my trade after a failure?

Only if you have a clear reversal setup and the skill to manage the new position.

How can I prevent big losses on failed patterns?

Always use stop-loss and never risk more than 1–2% of your capital on a single trade.

Do pattern failures happen more during specific times?

Yes, failures are more common during news releases, lunch hours, or illiquid market sessions.