Best Chart Patterns for 5-Minute Intraday Trades

The 5-minute chart is one of the most popular timeframes for intraday traders. It provides a balanced view—fast enough to catch quick moves, but stable enough to reduce false signals. In this article, we’ll explore the best chart patterns that consistently work on the 5-minute timeframe.

Why Use the 5-Minute Chart?

- Ideal for scalping and quick intraday trades.

- Offers more confirmation than the 1-minute chart.

- Allows enough setups throughout the trading day.

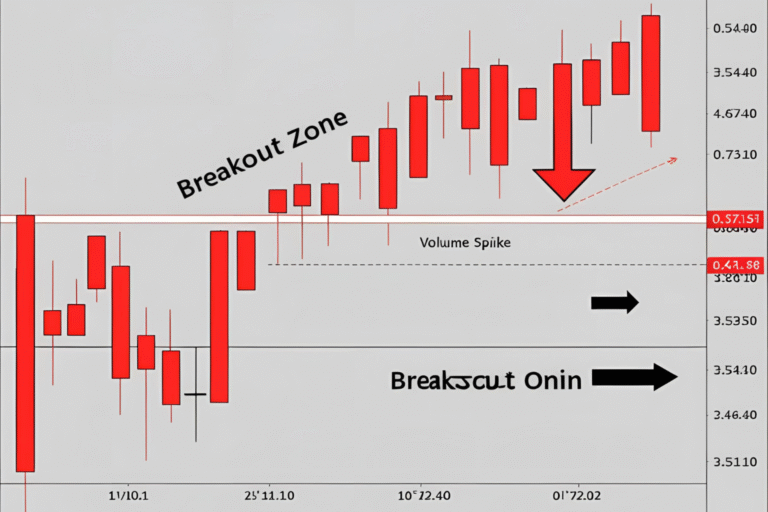

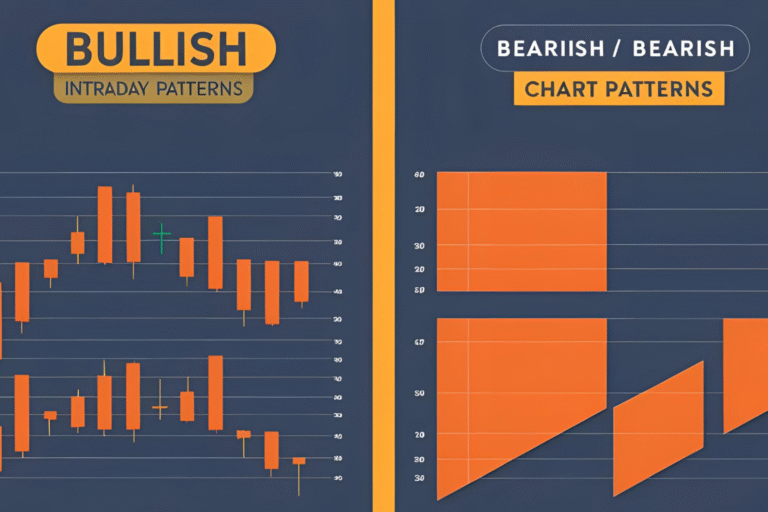

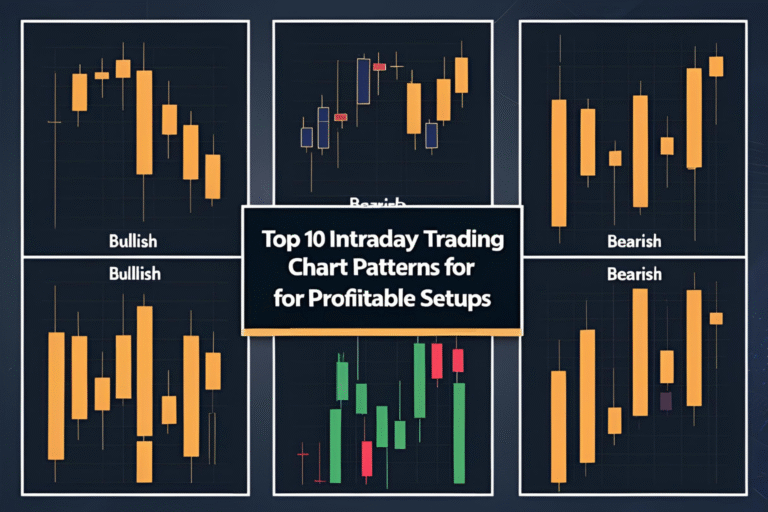

1. Bull Flag on 5-Minute Chart

After a sharp move up, price consolidates in a downward channel. Breakout confirms continuation.

Entry Tip: Buy after breakout with volume spike.

2. Bear Flag on 5-Minute Chart

Forms after a steep decline followed by an upward pause. Breakdown continues bearish trend.

Entry Tip: Short when price breaks below the lower channel.

3. Triangle Breakout

Price squeezes into a symmetrical triangle. Breakouts are usually strong.

Entry Tip: Trade in the direction of breakout after candle close.

4. Double Bottom

Two lows at nearly the same level. Bullish reversal when neckline is broken.

Entry Tip: Buy on neckline breakout; stop-loss just below recent low.

5. Double Top

Two peaks at similar highs. Bearish reversal if neckline support is broken.

Entry Tip: Sell after neckline breakdown with increased volume.

6. Micro Cup and Handle

This smaller version of the cup and handle can appear within 10–15 candles on a 5-min chart.

Entry Tip: Buy on handle breakout above resistance.

7. Inside Bar Breakout

A bar that fits within the previous bar’s high-low range. Indicates consolidation.

Entry Tip: Enter on breakout from the inside bar range.

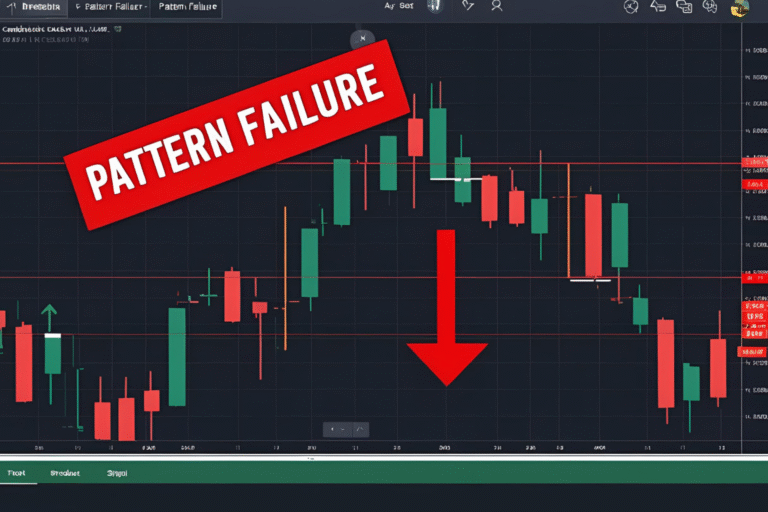

Tips for Trading 5-Minute Patterns

- Volume is critical: Always confirm with a volume increase.

- Avoid news time: Volatility can lead to false signals.

- Use stop-loss: Even 5-minute trades require strict risk control.

- Combine with EMA or VWAP: For extra trend confirmation.

Final Thoughts

The 5-minute chart is perfect for spotting quick trade setups. By mastering these patterns and following confirmation rules, traders can take advantage of small but consistent intraday moves. With discipline, even short timeframes can deliver reliable results.

FAQs

Are chart patterns reliable on 5-minute charts?

Yes, especially when confirmed by volume and traded with a proper stop-loss.

What’s the best pattern for quick entries?

The bull flag and triangle breakout are both excellent for fast execution.

Can beginners trade on the 5-minute chart?

Yes, but start with paper trading to avoid losses from inexperience.

How many trades can I take on a 5-minute chart?

That depends on market conditions, but 2–5 quality setups a day are common.

Do indicators help with 5-minute patterns?

Yes, tools like VWAP, RSI, and EMA lines can improve trade timing.