Entry and Exit Strategies Using Intraday Chart Patterns

Knowing the chart pattern is just the beginning. In intraday trading, timing your entry and exit based on the pattern structure can make the difference between consistent profits and avoidable losses. This guide focuses on how to enter and exit trades effectively using popular intraday chart patterns.

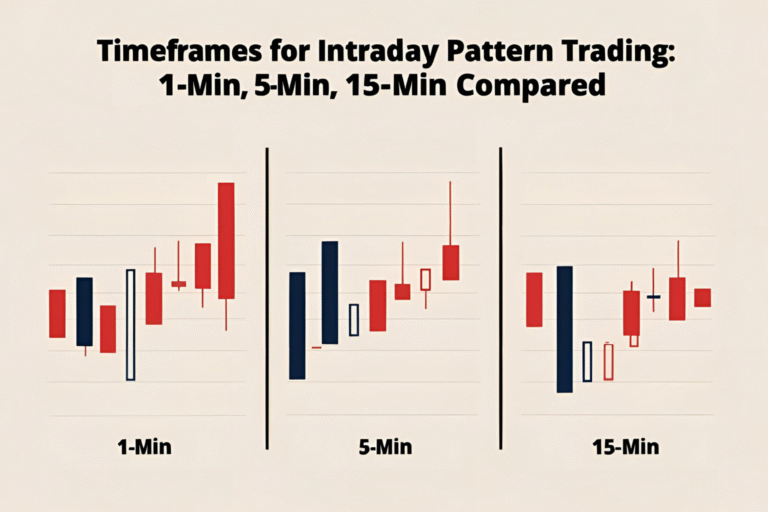

Why Entry and Exit Timing Matters

- Early entry: Risk of false breakout or reversal.

- Late entry: Reduced profit and higher risk.

- Poor exit: Can turn profits into losses or miss better opportunities.

With a clear entry and exit strategy, your trading becomes more systematic and less emotional.

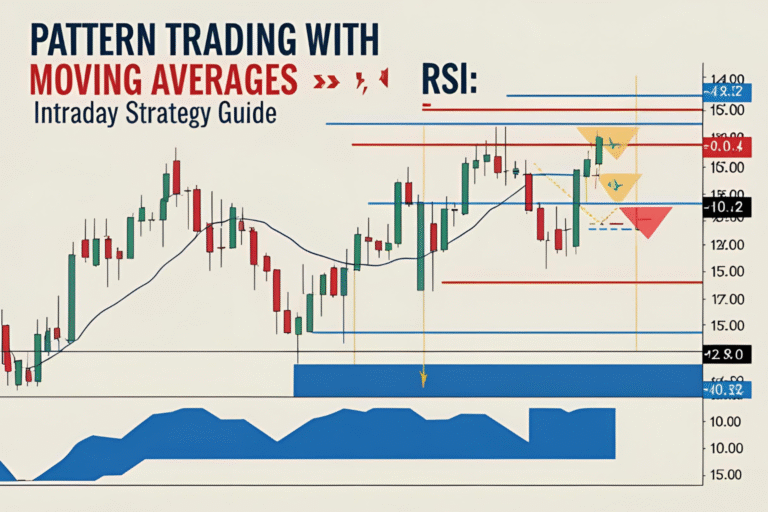

Entry Techniques Based on Chart Patterns

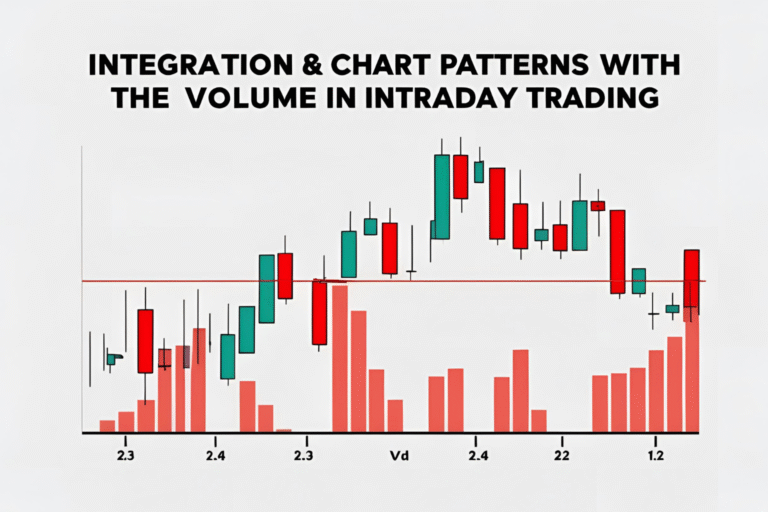

1. Breakout Entry

- Use when: Trading patterns like triangles, flags, or rectangles.

- How: Enter after a candle closes above resistance or below support.

- Confirmation: High volume and momentum.

2. Retest Entry

- Use when: You miss the breakout.

- How: Enter on the first pullback to the breakout level.

- Tip: Look for a wick rejection or reversal candle.

3. Pre-Breakout Anticipation (Advanced)

- Use when: Experienced with reading price pressure.

- How: Enter within the pattern before the breakout.

- Risk: Higher. Always use tight stop-loss.

Exit Techniques for Intraday Trades

1. Fixed Risk-Reward Ratio

- Use a standard 1:2 or 1:3 ratio.

- For example, risk ₹100 to gain ₹200 or ₹300.

2. Support/Resistance-Based Exit

- Exit near the next resistance in a long trade, or support in a short trade.

3. Trailing Stop Exit

- Move your stop-loss as price moves in your favor.

- Helps lock in profits during strong moves.

4. Time-Based Exit

- Exit by a certain time if the pattern hasn’t played out.

- Useful during low-volatility sessions.

Stop-Loss Placement Rules

- For breakout trades: Below the last swing low (long) or above swing high (short).

- For reversal patterns: Just outside the pattern’s opposite edge.

Example: Entry & Exit Using a Bull Flag

- Entry: After candle closes above the flag resistance with volume.

- Stop-Loss: Below the flag support.

- Exit: At previous high or use 1:2 R:R.

Final Thoughts

Perfecting your entry and exit strategy is as important as recognizing the pattern. Stick to confirmed setups, use volume as a filter, and always trade with a plan. Over time, your precision will improve, and so will your profitability.

FAQs

What is the best entry method for intraday patterns?

Breakout confirmation with volume is the safest for most traders.

How do I know when to exit a trade?

Use a fixed target, support/resistance level, or a trailing stop based on price action.

Should I always wait for a candle to close before entry?

Yes, to avoid false signals and premature entries.

Is a retest entry better than a breakout entry?

Retests offer better risk-reward but require patience and confirmation.

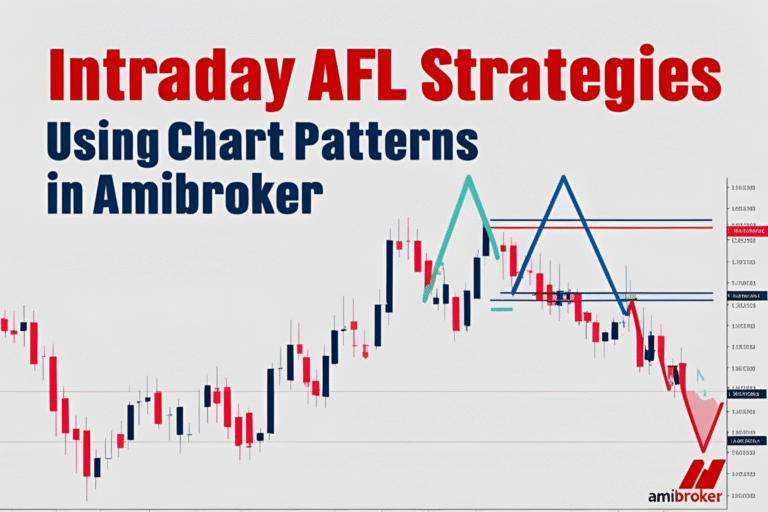

Can I automate my entries and exits?

Yes, with trading platforms that support scripting or alerts, but always monitor price behavior manually too.