Intraday AFL Strategies Using Chart Patterns in Amibroker

Chart patterns are powerful, but combining them with automated AFL (Amibroker Formula Language) strategies takes your intraday trading to the next level. This post walks you through how to use chart patterns in AFL to identify high-probability trades and execute them with speed and consistency.

What Is AFL in Intraday Trading?

AFL (Amibroker Formula Language) is the scripting language used in Amibroker, a popular trading platform. It allows traders to:

- Code strategies

- Generate signals based on patterns

- Backtest systems using historical data

- Automate alerts for intraday setups

Benefits of Using AFL with Chart Patterns

- Speed: Automated signals save time during fast market moves.

- Accuracy: Eliminates emotional decision-making.

- Backtesting: Validates pattern reliability on past data.

- Customization: Build your own pattern-based trading system.

Common Intraday AFL Strategies Based on Chart Patterns

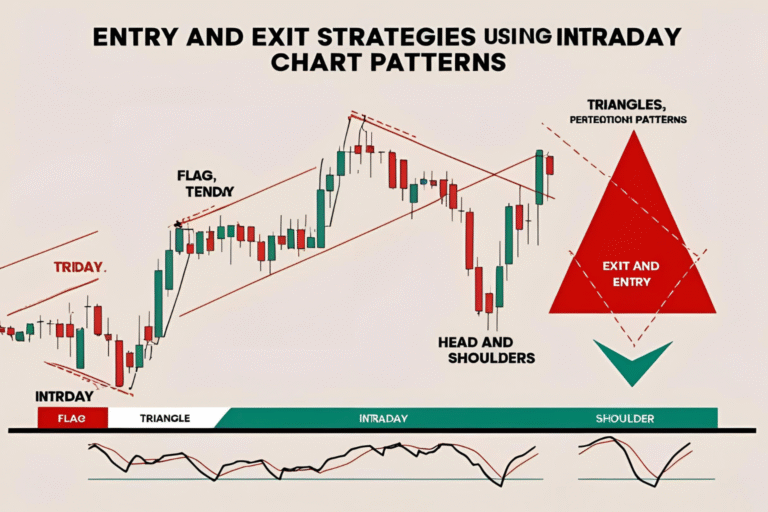

1. Breakout AFL (Triangles, Flags, Ranges)

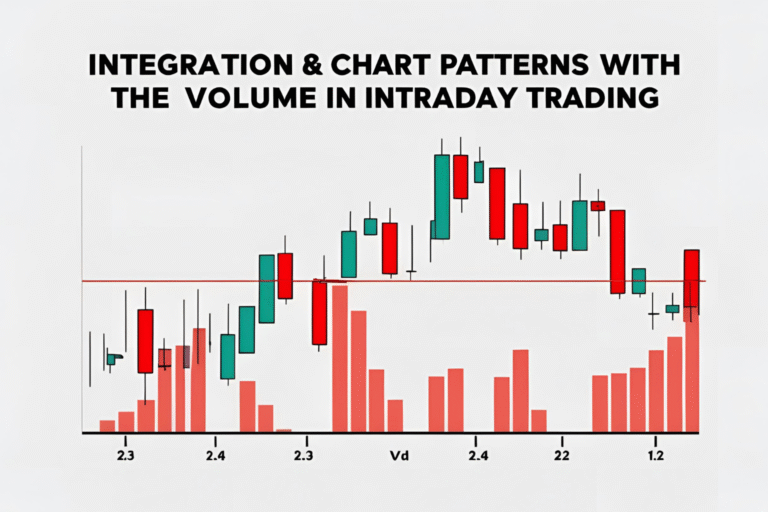

- Code checks for price crossing above resistance with volume.

- Entry: On candle close above resistance.

- Exit: Based on ATR or fixed reward-to-risk ratio.

2. Double Top/Bottom Pattern Detection

- AFL checks for two similar highs or lows within defined time gaps.

- Entry on neckline breakout.

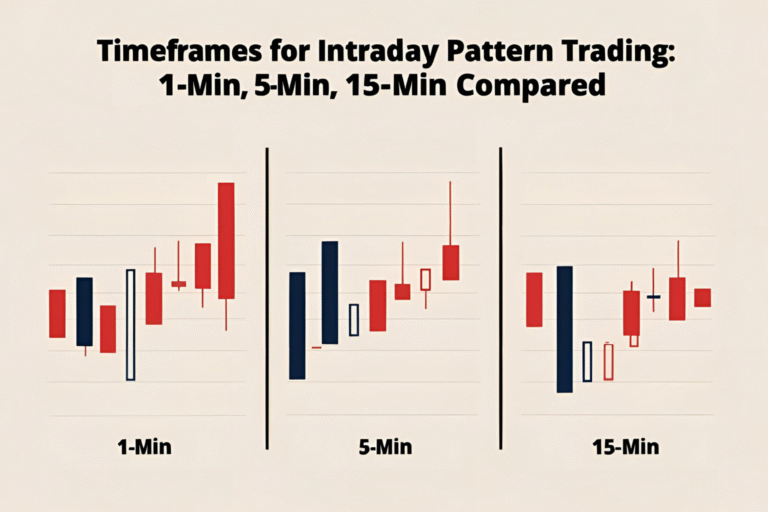

- Works well on 5-min or 15-min timeframes.

3. Reversal Candlestick AFL (Doji, Engulfing, Star Patterns)

- Detects specific candle shapes after trend movement.

- Entry: Confirmed reversal candle with volume.

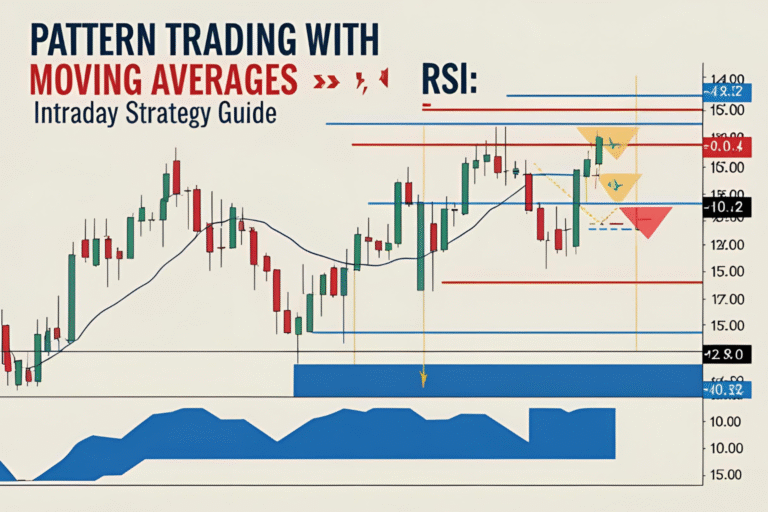

- Can be combined with RSI or moving average filters.

AFL Sample Code Snippet (Double Bottom Detection)

aflCopyEditPattern = (L < Ref(L, -1)) AND (Ref(L, -1) > Ref(L, -2)) AND

(Close > Ref(High, -1));

Buy = Pattern AND Volume > MA(Volume, 10);

Sell = Cross(MA(Close, 5), MA(Close, 10));

Note: This is a simplified example. Customization is essential for live trading.

Backtesting AFL Strategies in Amibroker

- Load historical intraday data.

- Insert AFL code.

- Run “Backtest” on your chosen chart pattern strategy.

- Analyze win rate, drawdowns, and risk-reward.

Best Practices for Intraday AFL Systems

- Test on multiple stocks and indices before going live.

- Optimize parameters like stop-loss, volume filters, and time ranges.

- Combine AFL logic with manual confirmation for better precision.

- Always paper trade before deploying real capital.

Final Thoughts

AFL strategies make intraday pattern trading more structured and efficient. Whether you use breakouts, reversals, or support/resistance-based entries, automating your logic with AFL saves time and improves accuracy. With backtesting and ongoing refinement, it can become a core part of your trading system.

FAQs

What is AFL in intraday trading?

AFL is the scripting language of Amibroker used to create and automate trading strategies.

Can I trade chart patterns automatically with AFL?

Yes, you can code pattern logic and set alerts or signals for intraday execution.

Do I need coding experience to use AFL?

Basic knowledge of syntax and logical structures is helpful, but many resources and templates are available.

Which patterns work best with AFL?

Breakouts, double tops/bottoms, and engulfing candles are commonly used.

Can AFL strategies be 100% automated?

Yes, but it’s advisable to monitor trades and combine with discretion in volatile markets.