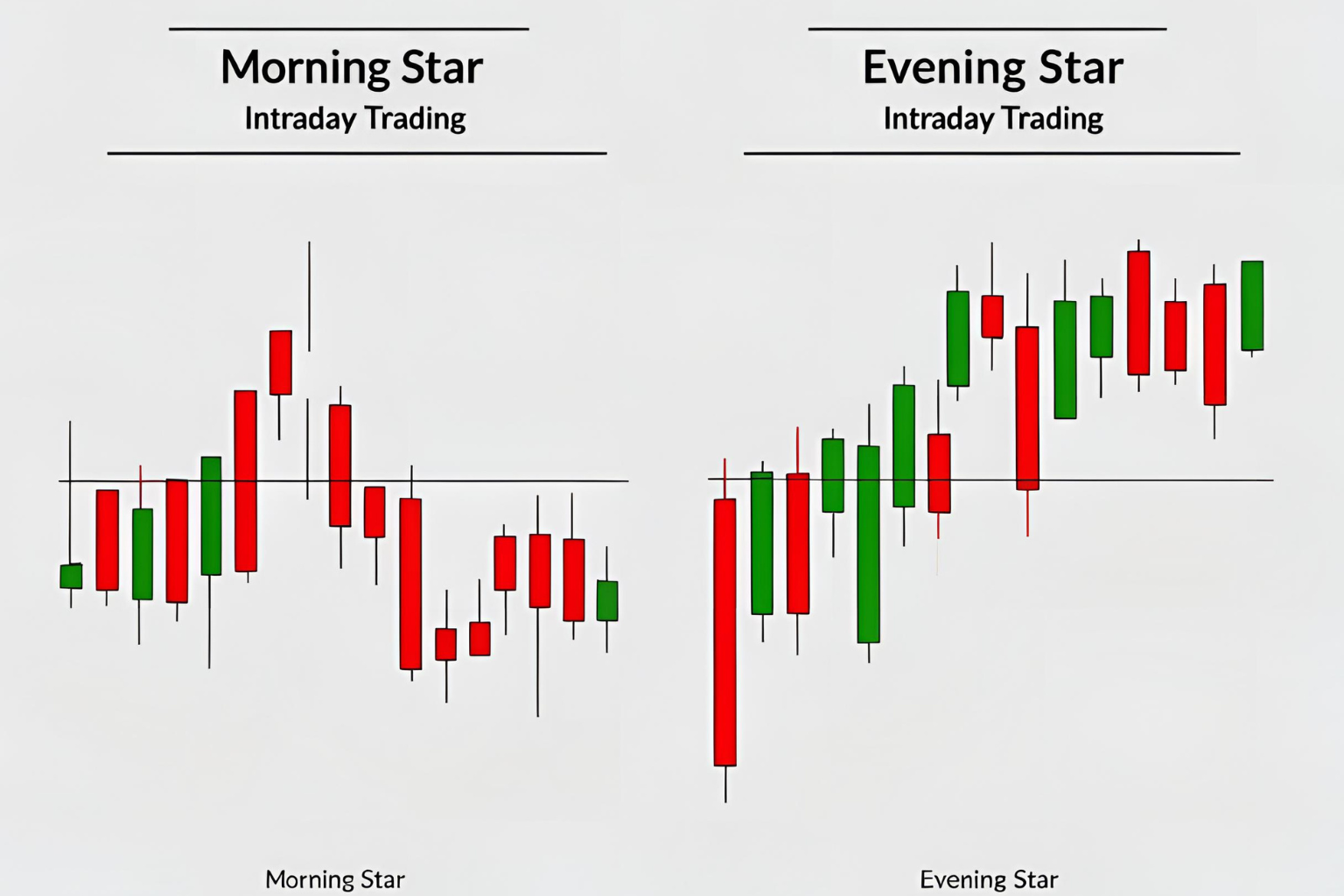

Morning Star and Evening Star in Intraday Trading

The Morning Star and Evening Star are two of the most effective candlestick reversal patterns used in intraday trading. These three-candle setups help traders identify trend reversals early, offering valuable entry and exit signals. In this guide, you’ll learn how to spot, confirm, and trade these patterns in fast-moving intraday markets.

What Is the Morning Star Pattern?

The Morning Star is a bullish reversal pattern that typically appears at the end of a downtrend.

Structure:

- First Candle: A long red candle indicating strong selling.

- Second Candle: A small-bodied candle (indecision).

- Third Candle: A strong green candle closing above the midpoint of the first.

Meaning: Sellers are losing strength, and buyers are taking over.

What Is the Evening Star Pattern?

The Evening Star is a bearish reversal pattern that appears at the top of an uptrend.

Structure:

- First Candle: A long green candle showing strong buying.

- Second Candle: A small-bodied candle (indecision).

- Third Candle: A strong red candle closing below the midpoint of the first.

Meaning: Buying momentum is fading, and sellers are gaining control.

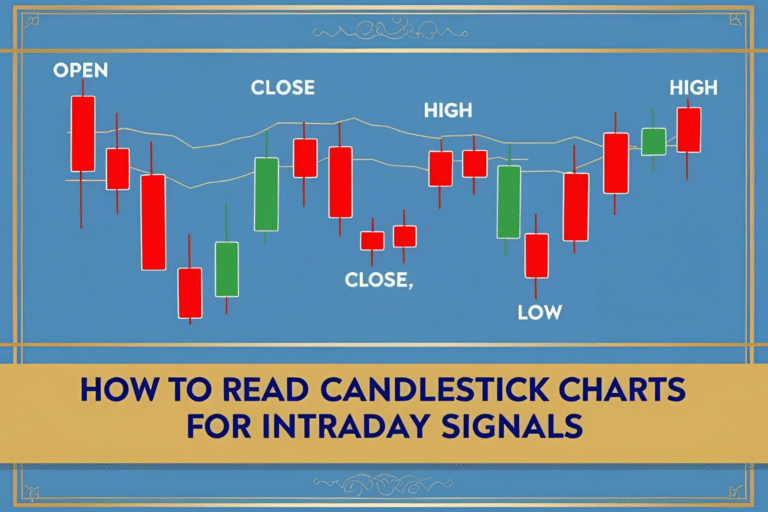

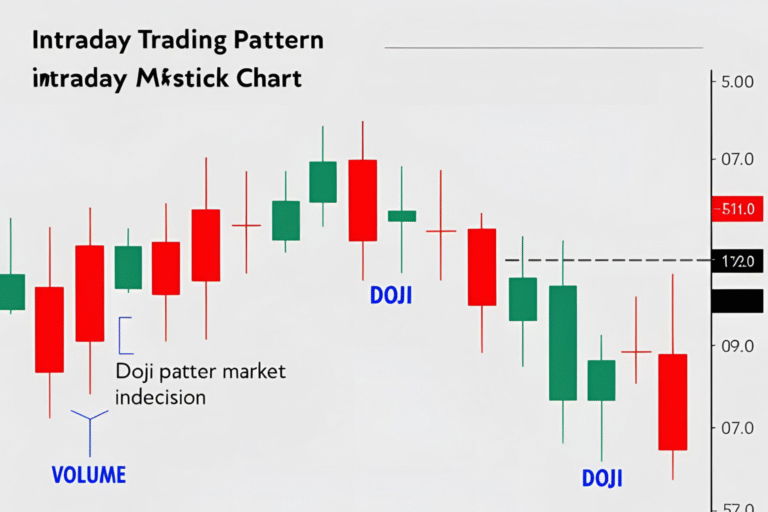

How to Identify Morning & Evening Star on Intraday Charts

- Use 5-minute or 15-minute candlestick charts.

- Look for the pattern after a clear trend (up or down).

- Confirm with volume surge on the third candle.

- Align with support or resistance levels for stronger signals.

Trading the Morning Star

- Entry: Above the high of the third (bullish) candle.

- Stop-Loss: Below the low of the entire pattern.

- Target: Prior resistance level or 1:2 risk-reward ratio.

Trading the Evening Star

- Entry: Below the low of the third (bearish) candle.

- Stop-Loss: Above the high of the entire pattern.

- Target: Previous support or key swing low.

Tips for Intraday Use

- Avoid patterns during low volume sessions (like lunch hours).

- Combine with RSI or moving averages for confirmation.

- Watch for fake stars—especially if the third candle lacks volume.

Final Thoughts

Morning Star and Evening Star patterns offer intraday traders clear setups with defined risk and reward. These patterns signal powerful shifts in momentum when used in the right context. With practice, they can become a core part of your trading strategy.

FAQs

Do Morning Star and Evening Star work well for intraday trading?

Yes, especially on 5-min and 15-min charts when confirmed by volume and trend context.

Can beginners trade these patterns?

Absolutely. They are clear and easy to spot with basic candlestick knowledge.

What confirms a valid star pattern?

The third candle must close beyond 50% of the first candle’s body and have decent volume.

How often do these patterns appear intraday?

They appear multiple times a day, especially during trend reversals or market open/close sessions.

Should I use indicators with star patterns?

Yes, tools like RSI or VWAP can add confirmation and reduce false signals.